As the United States gradually recovers from the COVID-19 pandemic, many investors want to know what is safe to buy and when it is time to sell certain positions. To help investors decide, the personal-finance website WalletHub, has released its report on Popular Stocks That Hedge Funds Are Buying, which examines the biggest holdings, buying, and selling activity over 400 hedge funds. The following are some highlights from the report:

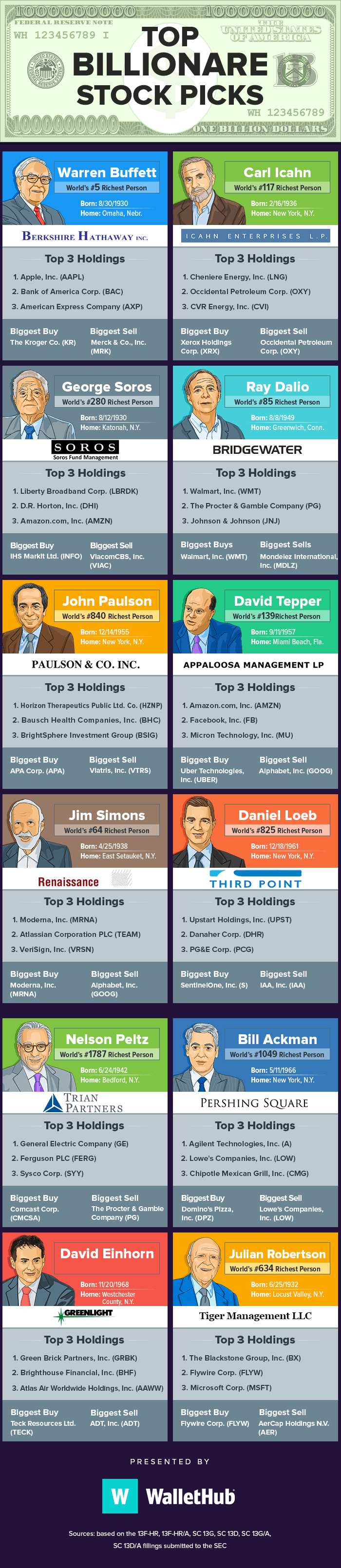

| Billionaire | Biggest Purchase | Biggest Sale |

| Warren Buffett | The Kroger Co. (KR) | Merck & Co., Inc. (MRK) |

| George Soros | IHS Markit Ltd. (INFO) | ViacomCBS, Inc. (VIAC) |

| Carl Icahn | Xerox Holdings Corp. (XRX) | Occidental Petroleum Corp. (OXY) |

| David Tepper | Uber Technologies, Inc. (UBER) | Alphabet, Inc. (GOOG) |

| John Paulson | APA Corp. (APA) | Viatris, Inc. (VTRS) |

For the full report, including an embeddable infographic, please visit:

In 2020, the stock market experienced greR volatility due to the COVID-19 pandemic. 2021 has been an interesting year as well, with the market working to recover from the damage done by the pandemic and has seen an unprecedented situation where small-time investors banded together to put short-sellers in hot water.

Regardless of how the market might fluctuate, though, it’s a fact that total hedge fund holdings are massive, around $3 trillion. To put that in perspective, only four countries, including the U.S., have a GDP higher than that. Furthermore, hedge fund managers often earn hundreds of thousands of dollars per year, but there are many who are billionaires.

It makes sense that people pay attention to what hedge fund managers are buying, selling and holding, especially during these times of economic uncertainty. Hedge funds’ quarterly public disclosures, mandated by the Securities and Exchange Commission, give us a window into their recent activity. To make sound investment decisions, it is important to monitor the biggest holdings, new positions, and recent exits of the top hedge funds.

Diversification Is Key to Investing

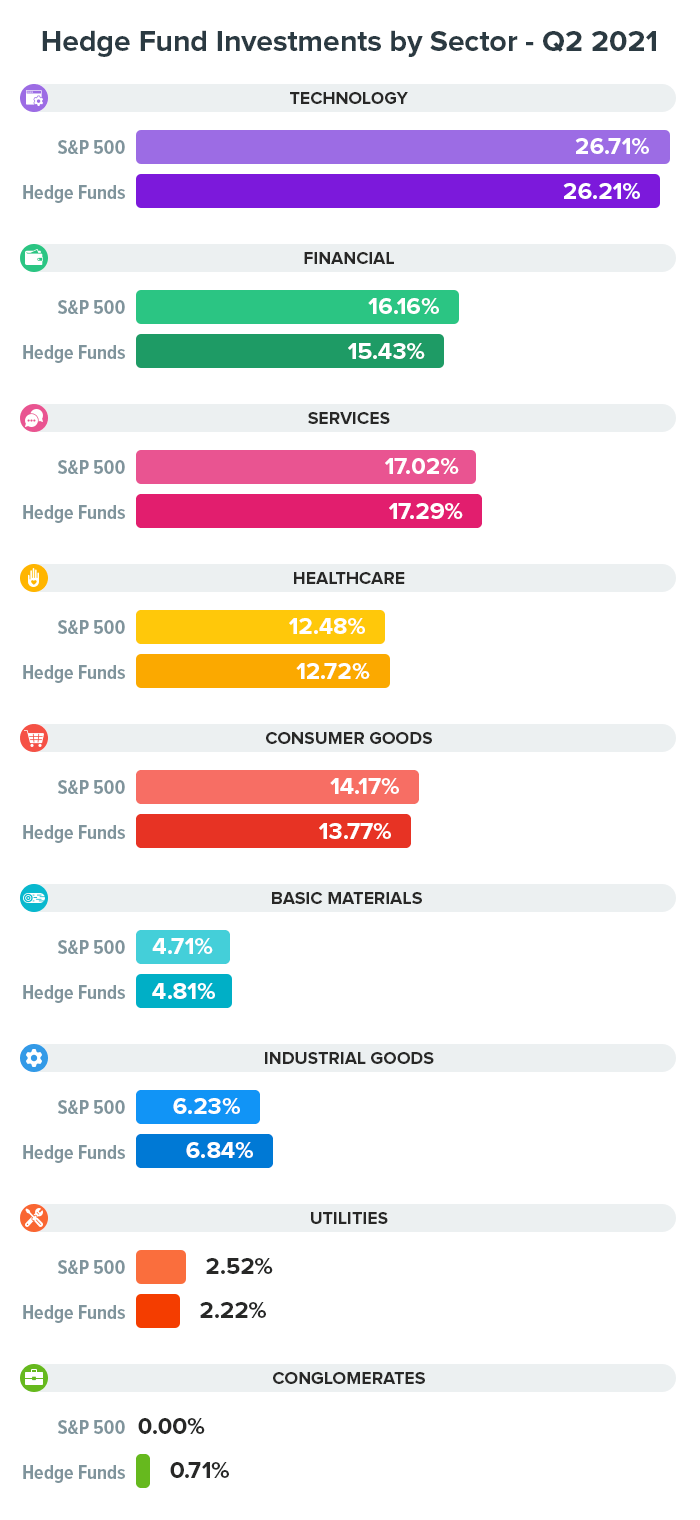

Spreading investments around reduces risk and allows you to benefit from the broader market’s long-term upward trend. That is why even the world’s best investors hedge their bets by allocating capital to various segments of the economy. But it is important to know that investments do not simply match the economy’s makeup or remain the same year to year.

Here is a breakdown of where the money was during Q2 2021.

The Time to Be Greedy

Be fearful when others are greedy & greedy when others are fearful. – Warren Buffet’s advice on taking big risks on valuable investments. Visit our home page www.fromgirlrogirl.com more tips.